Trusted by Global Banks to Operationalize Agentic AI

React to Market Changes 90% Faster with Confidence in Your Security and Compliance- Up to 80% reduction in operational costs

- 4X faster time-to-market with our AI agents

Schedule a Demo

Automate to Stay Ahead of Counterparty Credit Risk

Reduce risk in real time for financial portfolios and business and real estate credit applications and loans due to delayed insights.

- Problem: Loan application review, risk analysis and compliance rely on slow, manual processes to assess portfolio exposure in volatile markets. Regulatory compliance and review further slow down workflows.

- Solution: Squid AI agents automate credit and loan request analysis according to the bank policies and guidelines, saving 50% of time and costs and ensuring capital adequacy.

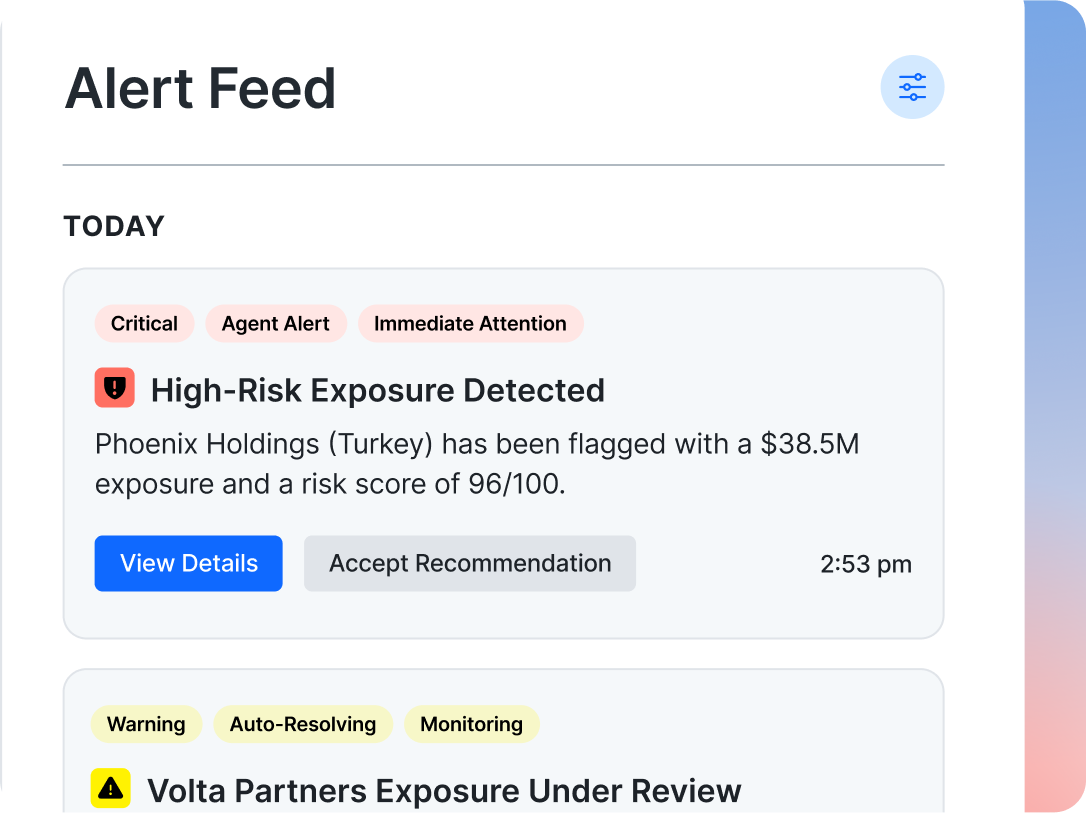

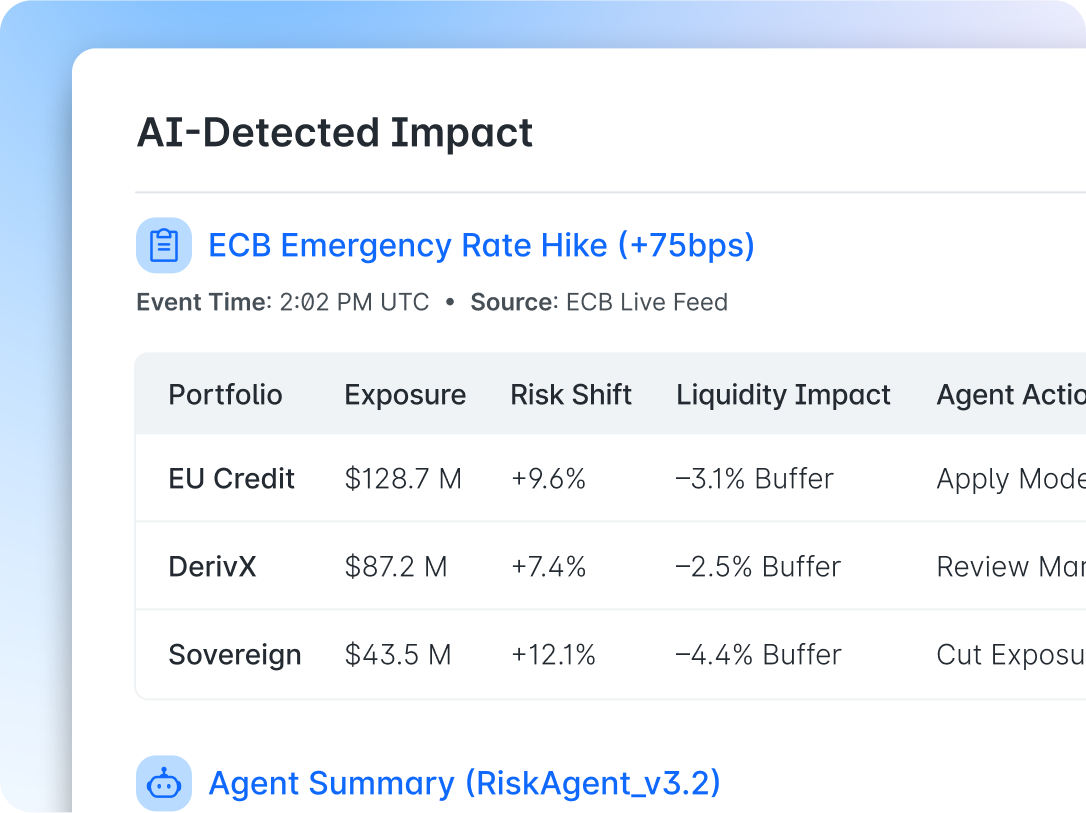

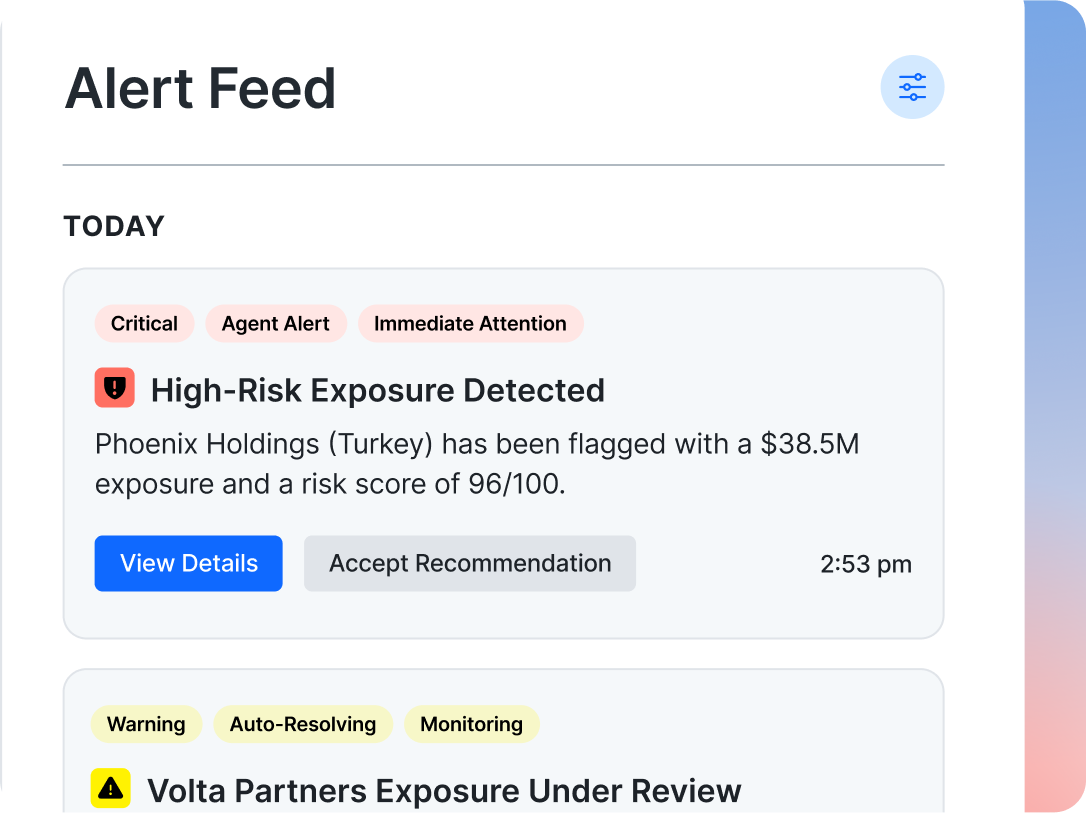

Respond Instantly to Geopolitical, Regulatory, and Macro Events

Dynamically adapt to market conditions, regulatory events, and new earnings reports before exposure turns into loss.

- Problem: It’s hard to see your full exposure during fast-moving market or geopolitical events.

- Solution: Agents trace portfolio impact in real time and provide insights and recommendations accordingly for better client satisfaction and portfolio performance.

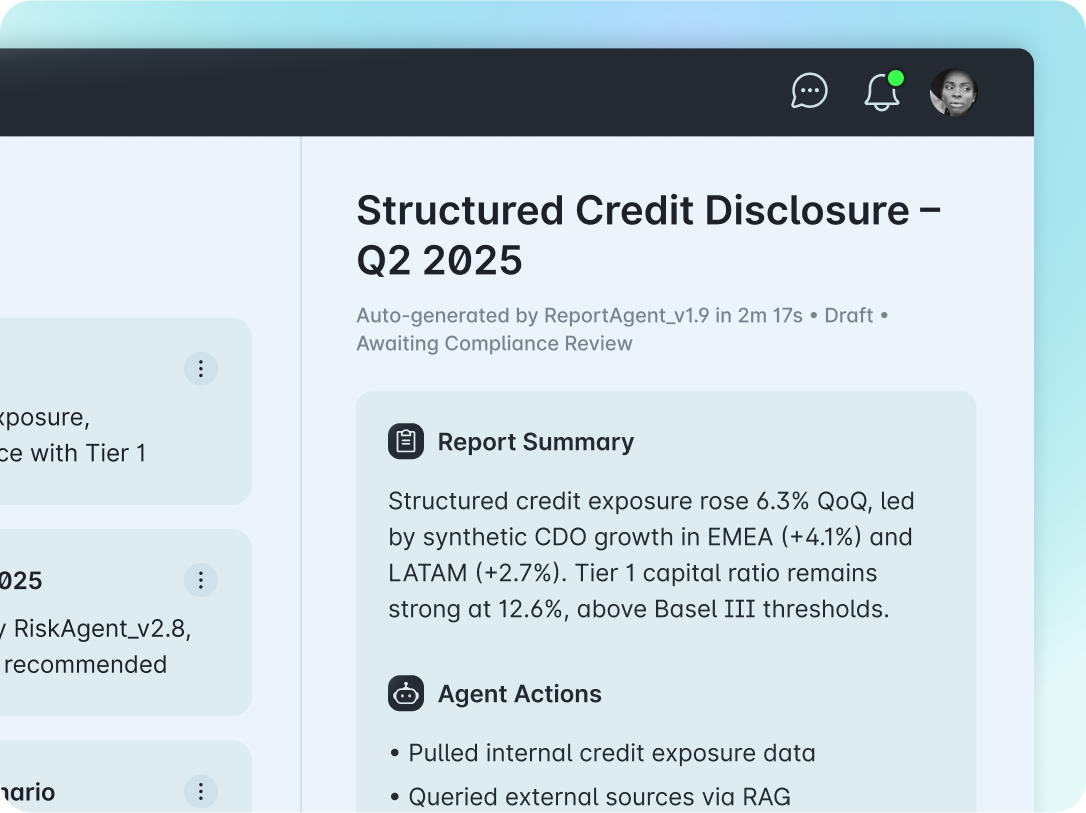

Process Information at Scale to Surface Insights Quickly

Compliant credit risk, loan risk, and market risk reports and alerts, auto-generated and source-backed in a fraction of the time.

- Problem: Analyzing vast amounts of content requires extensive manual research and effort. Compliance and review further slow down workflows.

- Solution: An agent pulls trusted data, analyzes and formats it properly to your data metrics, and delivers engaging, consistent, and accurate reports.

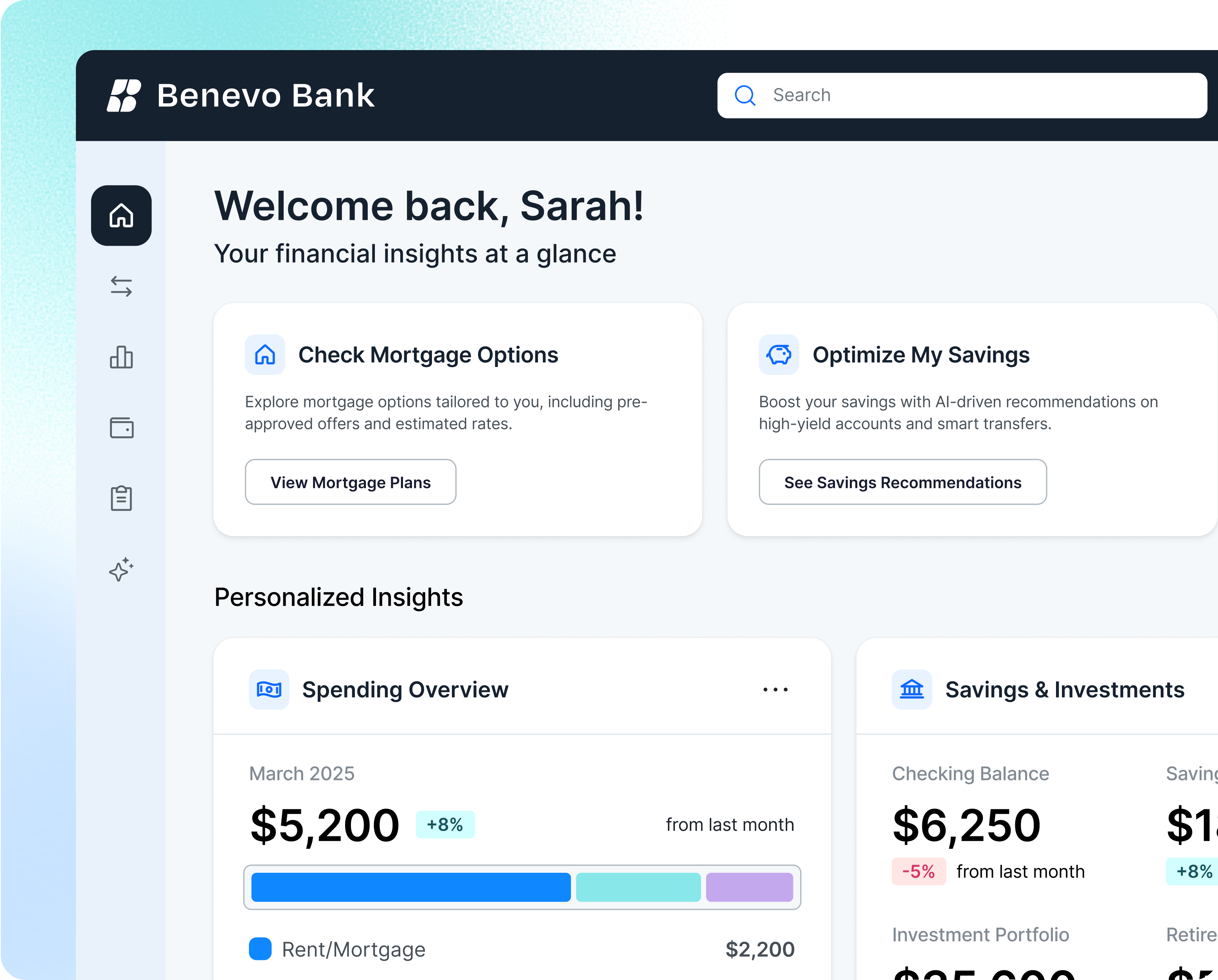

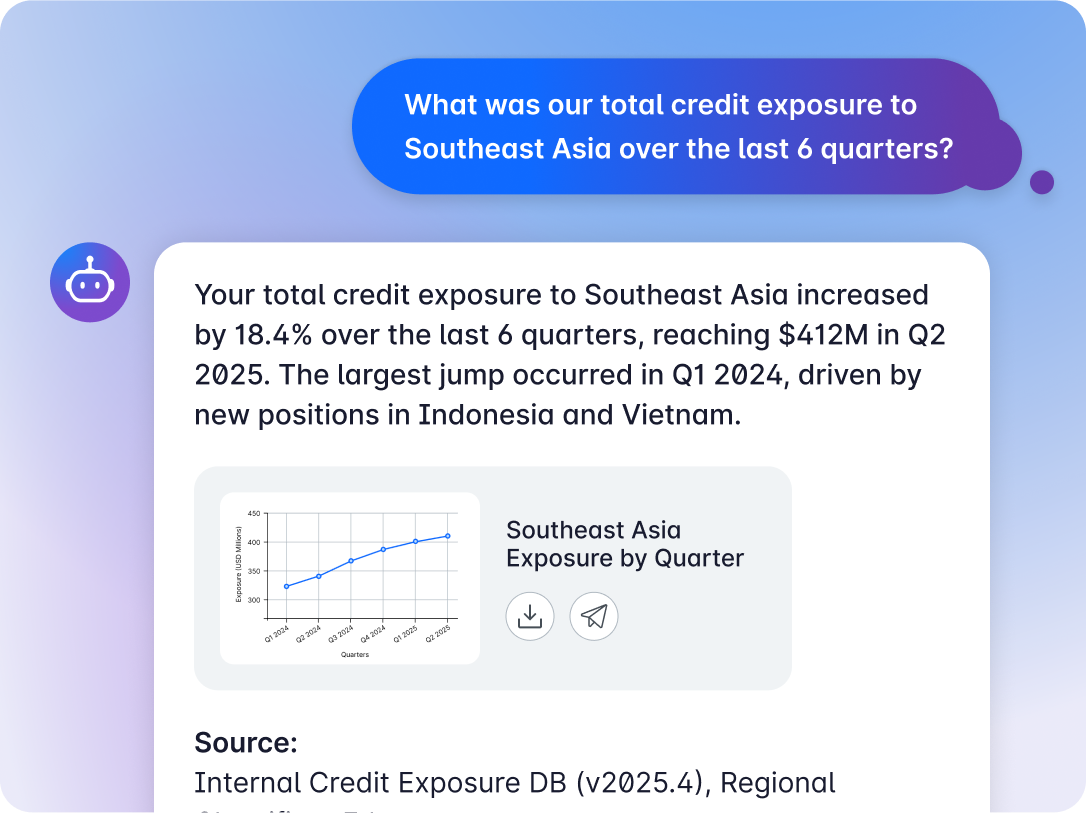

Insights from Institutional Data in Seconds for Everyone

Answers for all of your business users at their fingertips, without the manual effort.

- Problem: Business and risk teams still rely on analysts and data teams to write queries to get answers stuck in siloed data.

- Solution: Squid AI lets anyone ask questions in plain English and get sourced answers and data visualizations in seconds. No query knowledge or searching for the right data source required.

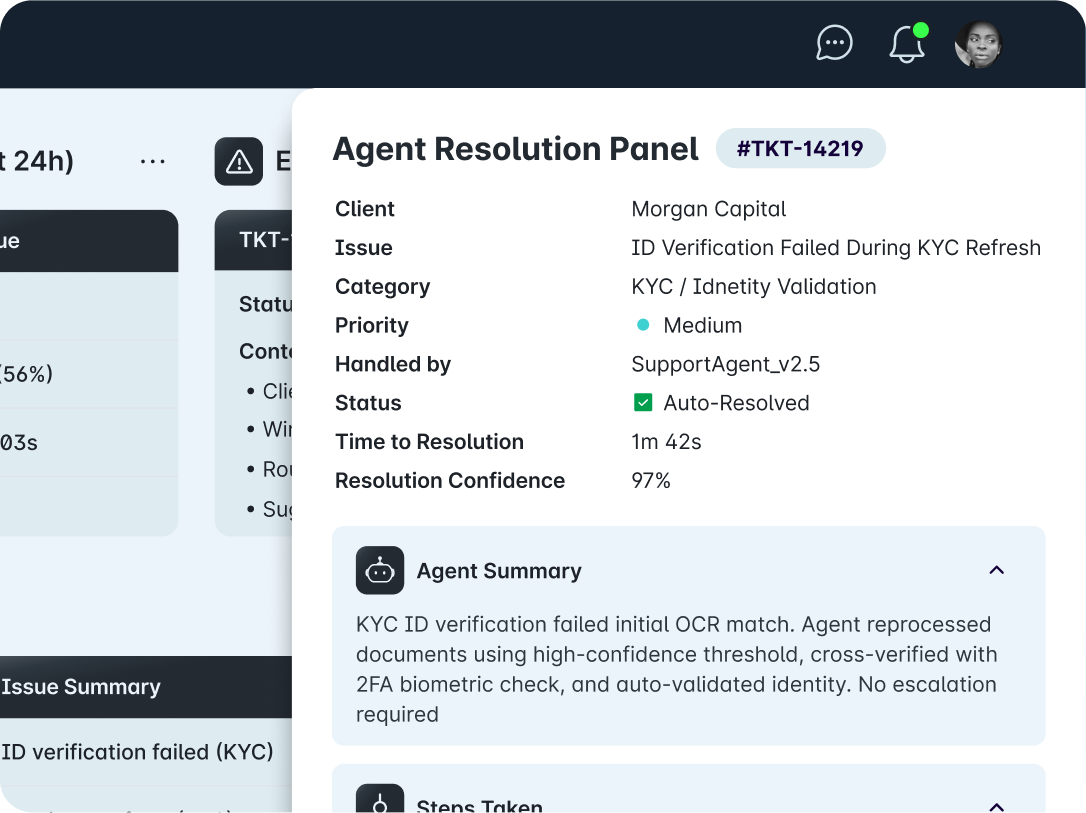

Automate Client Support Without Sacrificing Service

Improve speed and quality of client service at lower cost.

- Problem: High ticket volumes increasingly overwhelm support teams and delay resolutions.

- Solution: Agents resolve routine tickets instantly, handle KYC/AML requirements, and escalate complex ones with full 360-degree customer context.

Automate to Stay Ahead of Counterparty Credit Risk

Reduce risk in real time for financial portfolios and business and real estate credit applications and loans due to delayed insights.

- Problem: Loan application review, risk analysis and compliance rely on slow, manual processes to assess portfolio exposure in volatile markets. Regulatory compliance and review further slow down workflows.

- Solution: Squid AI agents automate credit and loan request analysis according to the bank policies and guidelines, saving 50% of time and costs and ensuring capital adequacy.

Respond Instantly to Geopolitical, Regulatory, and Macro Events

Dynamically adapt to market conditions, regulatory events, and new earnings reports before exposure turns into loss.

- Problem: It’s hard to see your full exposure during fast-moving market or geopolitical events.

- Solution: Agents trace portfolio impact in real time and provide insights and recommendations accordingly for better client satisfaction and portfolio performance.

Process Information at Scale to Surface Insights Quickly

Compliant credit risk, loan risk, and market risk reports and alerts, auto-generated and source-backed in a fraction of the time.

- Problem: Analyzing vast amounts of content requires extensive manual research and effort. Compliance and review further slow down workflows.

- Solution: An agent pulls trusted data, analyzes and formats it properly to your data metrics, and delivers engaging, consistent, and accurate reports.

Insights from Institutional Data in Seconds for Everyone

Answers for all of your business users at their fingertips, without the manual effort.

- Problem: Business and risk teams still rely on analysts and data teams to write queries to get answers stuck in siloed data.

- Solution: Squid AI lets anyone ask questions in plain English and get sourced answers and data visualizations in seconds. No query knowledge or searching for the right data source required.

Automate Client Support Without Sacrificing Service

Improve speed and quality of client service at lower cost.

- Problem: High ticket volumes increasingly overwhelm support teams and delay resolutions.

- Solution: Agents resolve routine tickets instantly, handle KYC/AML requirements, and escalate complex ones with full 360-degree customer context.

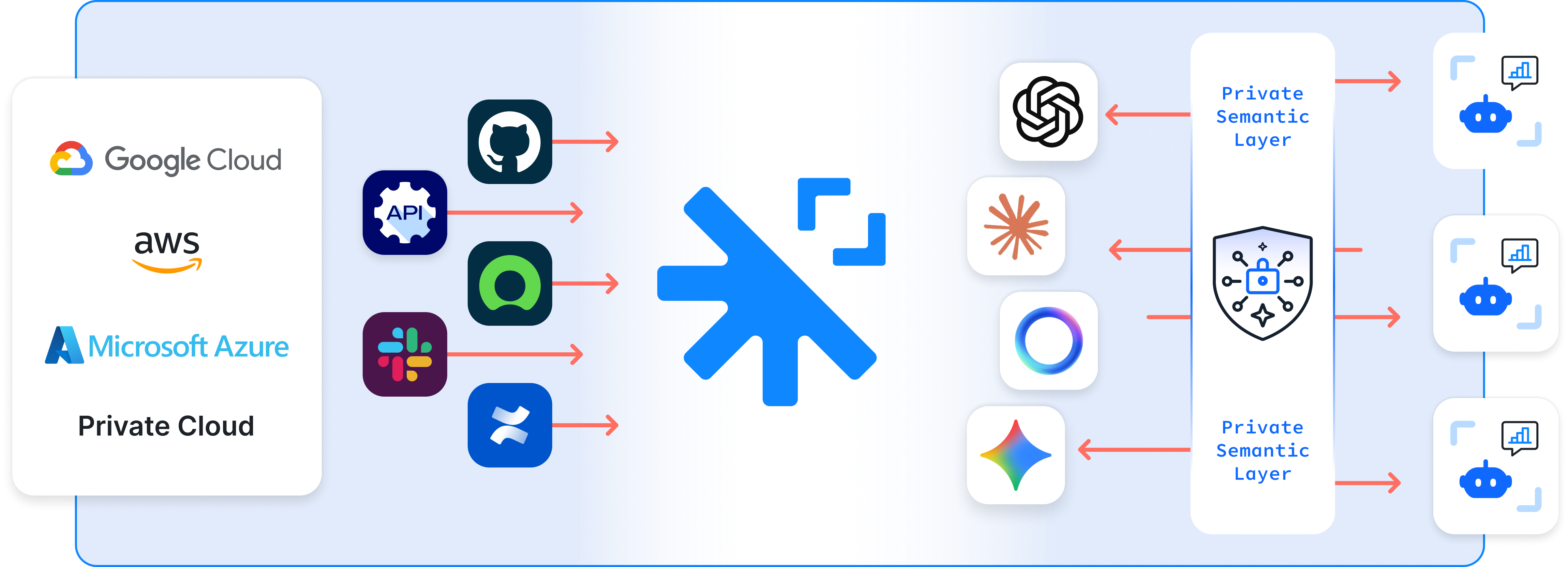

Trustworthy by design, SOC 2 Type II and ISO 27001 certified. Deployable in your VPC perimeter, including fully on premises.

Securely connects to all your data sources, even at scale, across clouds, VPCs, and on-prem environments. Zero data migration required.

Full explainability with detailed access controls, audit trails, feedback loops, and human-in-the-loop options.

Ability to deliver flows to production quickly and accurately, with a configurable platform and full observability.